Stock repurchases

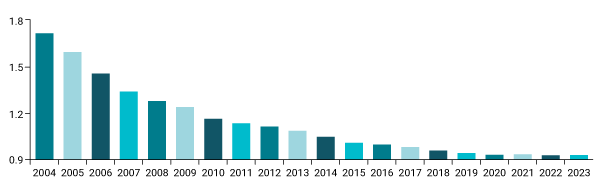

In the latter part of 2004, TI initiated a stock repurchase program to significantly reduce the number of shares that were outstanding. Since this program was implemented, we've reduced our share count 47%.

Share repurchases are made with the goal of the accretive capture of future free cash flow for long-term investors.

Today, stock repurchases are an essential part of our disciplined approach to capital management through which the company both generates cash and returns it to our shareholders. After accretive investments in the business to grow free cash flow for the long term, the remaining cash will be returned over time via dividends and share repurchases.

47% reduction in shares outstanding

(B shares)

| Year | Shares outstanding as of the period ending (M) |

Repurchased shares (M) | Repurchased ($M) |

|---|---|---|---|

| 2023 | 908 | 2 | $293 |

| 2022 | 906 | 22 | $3,615 |

| 2021 | 923 | 3 | $527 |

| 2020 | 919 | 23 | $2,553 |

| 2019 | 932 | 27 | $2,960 |

| 2018 | 945 | 49 | $5,100 |

| 2017 | 983 | 31 | $2,556 |

| 2016 | 996 | 35 | $2,132 |

| 2015 | 1,011 | 51 | $2,741 |

| 2014 | 1,047 | 62 | $2,831 |

| 2013 | 1,083 | 78 | $2,868 |

| 2012 | 1,108 | 60 | $1,800 |

| 2011 | 1,139 | 59 | $1,973 |

| 2010 | 1,167 | 94 | $2,454 |

| 2009 | 1,240 | 45 | $954 |

| 2008 | 1,278 | 80 | $2,122 |

| 2007 | 1,343 | 147 | $4,886 |

| 2006 | 1,450 | 172 | $5,302 |

| 2005 | 1,597 | 153 | $4,151 |

| 2004 | 1,718 | 30 | $753 |

Note: Repurchased shares are on a settlement date basis.